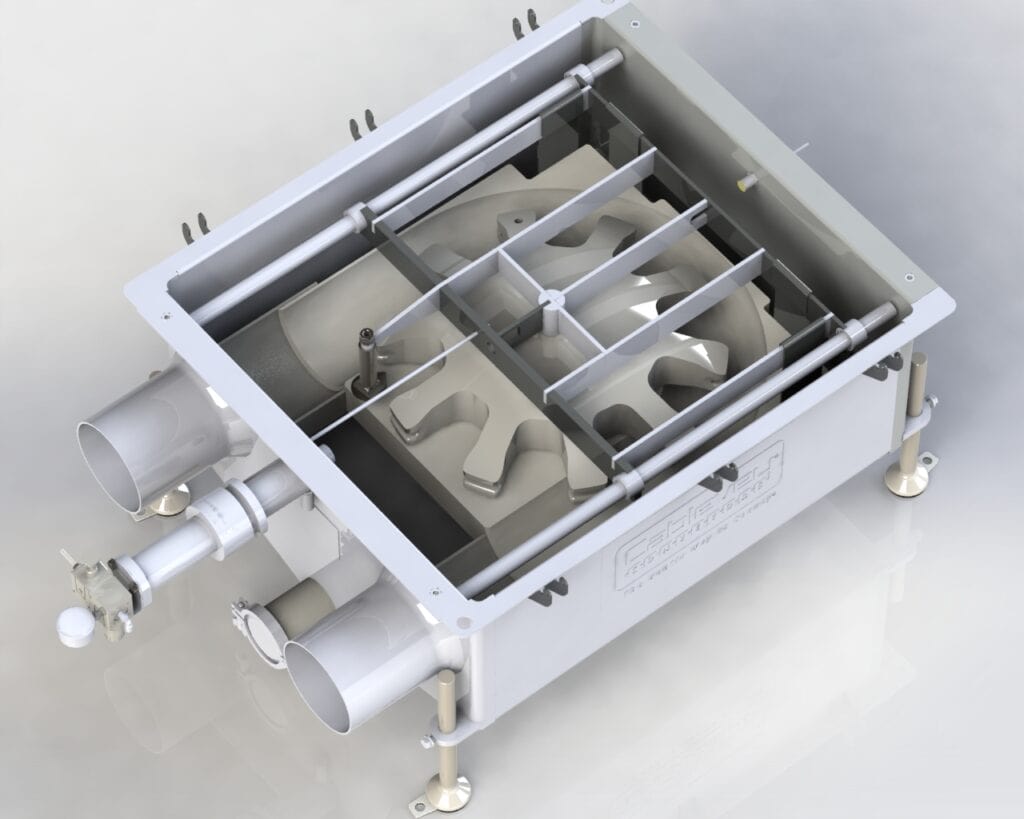

Cablevey® Conveyors designs and manufactures tubular drag and cable materials handling equipment and systems.

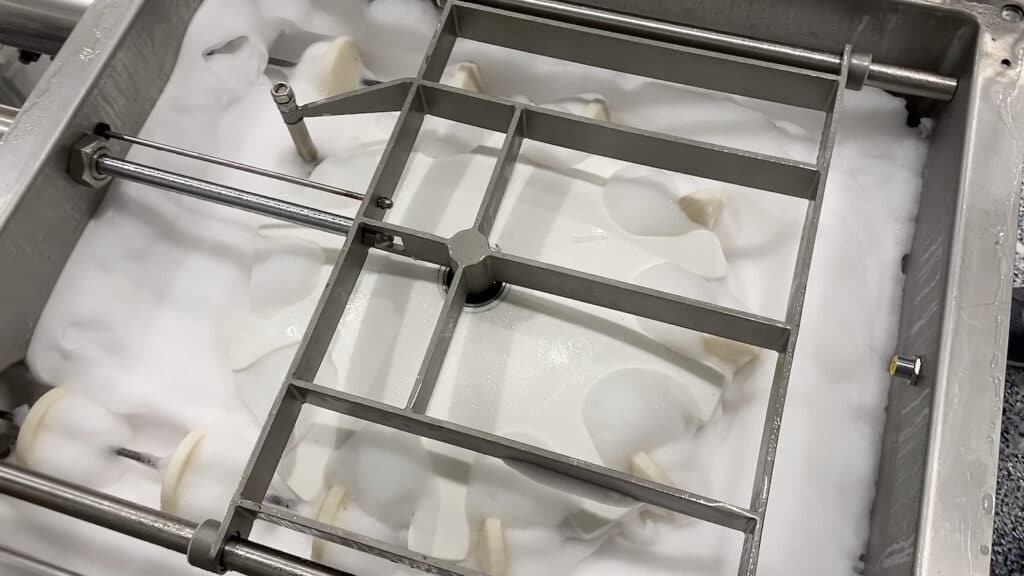

We’ve earned a global reputation as the industry leader for gentle yet efficient conveying technology that protects the integrity of friable materials. Based in Oskaloosa, Iowa, Cablevey has designed, engineered, and serviced its enclosed cable and disc tube conveyors for over 50 years with installations in over 65 countries.

May River Capital acquired Cablevey in 2021. This acquisition maintained the essential character already established at Cablevey while expanding our capability to test and refine new products for our Tier 1 customers in our core food and beverage sectors, such as tree nuts, coffee, breakfast cereal, grains and pet food. It also broadened our reach into other areas of bulk material handling of delicate products, including pharmaceuticals, and a broad range of industrial materials including powders, plastics, pellets and more.